Considering the Assumptions and Estimates Used to Develop the Recommendation

CFP Board has developed a series of case studies to provide practical guidance to CFP® professionals and their firms on the new Code and Standards. Each case study presents a hypothetical factual circumstance and then asks a question about a CFP®professional’s duty in that circumstance under the Code and Standards.

Hank, a CFP® professional, meets with new client Cindy, who has engaged Hank for financial planning. Cindy is a 40-year-old widow with a 10-year-old daughter, Susie. During their initial meeting, Cindy tells Hank she would like to move to a bigger home, retire by age 67 and pay for her daughter’s college tuition.

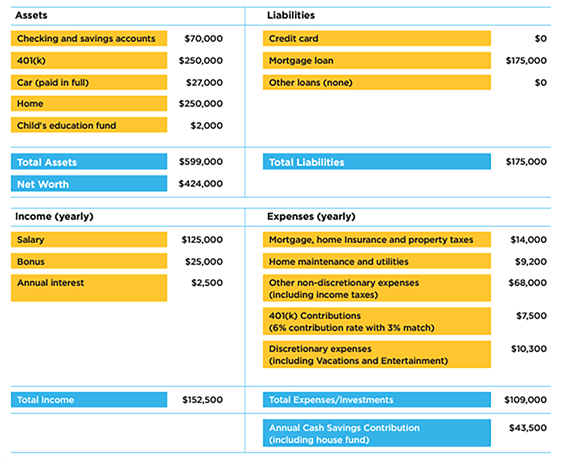

Hank engaged in additional communications with Cindy to understand her personal and financial circumstances, obtaining both qualitative and quantitative information:

Cindy currently lives in a townhome. She desires a bigger house with a large yard so that her daughter may have extra space. She is considering making an offer on a home with a current market value of $500,000. She has been saving for several years and wants to make a 20% down payment to avoid paying for private mortgage insurance. The new mortgage payment (including escrow for homeowner’s insurance and taxes, principal and interest) for a 30-year mortgage would be approximately $3,400 monthly at her approved 6.5% mortgage interest rate ($40,800 annually). She also anticipates that her annual utilities and home maintenance expenses would increase to $11,200.

Cindy has saved $2,000 toward her daughter’s college education and would like to provide for the full cost of an in-state public university. Cindy also would like to retire in 27 years at age 67.

After the discussion, and based upon the estimates and assumptions above, Hank developed these three major financial planning recommendations.

- Cindy’s current house has a market value of $250,000, a mortgage balance of $175,000 and equity of $75,000, with an estimated $25,000 in total closing costs for the sale of the prior home and purchase of the new home. This leaves approximately $50,000 in net equity that she may use to make a down payment. Comparable townhomes have sold quickly and at a steady price. Hank concurs that Cindy can sell her current home and make an offer on the home she is considering. He recommends that she make a $100,000 down payment so that she may avoid paying additional mortgage insurance costs. Hank recommends that Cindy use $50,000 from her savings account toward the down payment of the new home, leaving $20,000 in her savings account.

- To retire at age 67, Hank recommends that Cindy increase her current 401(k) plan contributions to $10,500 annually, a $3,000 increase from her current annual contributions. This would enable Cindy to retire with a similar standard of living at her desired retirement age.

- Cindy has eight years until her daughter is expected to go to college. Currently, the cost of tuition, room and board at the state university Cindy’s daughter aspires to attend is $27,000 per year. Hank makes some calculations that consider likely inflation in the cost of college expenses. He determines that to pay for her daughter's college tuition, Cindy must save $11,000 per year. Cindy previously opened a 529 account but has contributed only $2,000 to the account. Hank recommends that Cindy begin immediately making monthly contributions to the 529 plan, in the amount of $917, to make progress toward this goal.

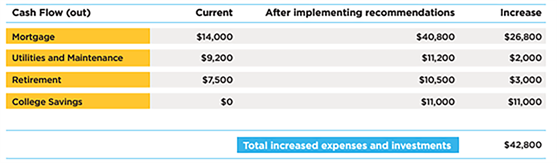

Using Cindy’s assumptions, Hank calculates the annual increases in Cindy’s expenses and contributions to retirement and college savings as follows:

Purchasing the house with 20% down and implementing the other recommendations will decrease Cindy’s cash flow by $42,800, which is roughly equivalent to Cindy’s current annual cash savings rate of $42,500.

Hank presents the three recommendations to Cindy. Thereafter, Cindy begins to implement the plan, including by contracting to buy the house.

QUESTION:

Did Hank satisfy his duties when developing the Financial Planning recommendations? If not, what should Hank have done differently?

No. Hank did not:

- Estimate an adequate emergency fund to account for unanticipated expenses or loss of income;

- Take uncertainty into account when considering assumptions and estimates while developing the Financial Planning recommendation.

DISCUSSION:

This case study involves the Practice Standards for the Financial Planning Process, Developing the Financial Planning Recommendation(s) (Standard C.4.)

Standard B.3. of the Code and Standards provides that a CFP® professional must comply with the Practice Standards for the Financial Planning Process when a CFP® professional agrees to provide, or provides, Financial Planning. Article C sets forth the Practice Standards for the Financial Planning Process, which includes the seven steps set forth below. This case study focuses on Step 4 of the Financial Planning Practice Standards, the text of which is provided in full below. You may review the other Practice Standards by clicking on the link provided:

- Understanding the Client’s Personal and Financial Circumstances

- Identifying and Selecting Goals

- Analyzing the Client’s Current Course of Action and Potential Alternative Course(s) of Action

- Developing the Financial Planning Recommendation(s)

From the potential courses of action, a CFP® professional must select one or more recommendations designed to maximize the potential for meeting the Client’s goals. The recommendation may be to continue the Client’s current course of action. For each recommendation selected, the CFP® professional must consider the following :

a. The assumptions and estimates used to develop the recommendation;

b. The basis for making the recommendation, including how the recommendation is designed to maximize the potential to meet the Client’s goals, the anticipated material effects of the recommendation on the Client’s financial and personal circumstances and how the recommendation integrates relevant elements of the Client’s personal and financial circumstances;

c. The timing and priority of the recommendation; and

d. Whether the recommendation is independent or must be implemented with another recommendation.

5. Presenting the Financial Planning Recommendation(s)

6. Implementing the Financial Planning Recommendation(s)

7. Monitoring Progress and Updating

In this case study, the CFP® professional, Hank, was engaged for Financial Planning. Hank, therefore, was required to comply with the Practice Standards. However, Hank did not develop a Financial Planning recommendation based on reasonable assumptions and estimates. Assumptions and estimates are approximations. A CFP® professional must plan for results that deviate from the assumptions and estimates, estimate an appropriate amount of emergency savings and discuss uncertainties and tradeoffs with the Client.

Hank did not estimate an adequate emergency fund when he recommended that Cindy leave only $20,000 in her savings account. Emergency funds (cash and cash equivalents) ordinarily should be sufficient to cover a reasonable estimate of the likely period that the Client would not be earning income, whether because of unemployment, medical leave or other circumstances. The lack of a sufficient emergency fund can cause a Client undue stress in the face of unexpected increases in expenses or decreases in income and could derail their financial plan.

Hank should have calculated the amount of emergency funds required, which would reasonably have been between three to six months of nondiscretionary expenses. The increase in mortgage and utilities increased Cindy’s non-discretionary expenses from $92,200 to $121,000 annually. Cindy would have required $30,250 in cash for her to have sufficient funds to pay for at least three months of non-discretionary expenses, or $60,500 in cash for her to have sufficient funds to pay for six months of non-discretionary expenses.

Hank also needed to make clear to Cindy the risks of increasing her nondiscretionary expenses and depleting her cash, in particular how it would negatively affect her ability to handle unexpected expenses. That way Cindy could accept that risk or explore tradeoffs or adjustments to her goals.

Having a discussion with Cindy about the priorities of her goals, as required in Step 2 of the Practice Standards, would have helped Hank discuss these risks and potential tradeoffs and incorporate them into his recommendations. For example, Hank might have discussed whether Cindy:

- Would be willing to make a smaller down payment and increase her monthly mortgage and insurance costs to have more emergency funds available for unexpected expenses or loss of income.

- Would be willing to adjust other goals, such as retiring later or paying for less of Susie’s tuition, should Cindy incur unanticipated expenses or lose income.

- Might purchase a less expensive home or wait to purchase a home until she has saved enough for both a down payment and emergency funds.

- Should identify other sources of emergency funds, such as a home equity loan that she might have available to use through a line of credit.

Relevant Standards and Definitions: Practice Standards for the Financial Planning Process, Step 4: Developing the Financial Planning Recommendation(s) (Standard C.4.).

Access More Guidance Materials

This compliance resource is part of a full library of resources that CFP® professionals can use to comply with the Code and Standards. More guidance materials can be found in our Compliance Resources Library.

Donate

Donate