Registered Program Content

To become a CFP Board Registered Program, schools must demonstrate coverage of the Principal Knowledge Topics within their curriculum. CFP Board released an updated list of Principal Knowledge Topics in March 2021, which became effective in January 2022.

Registered Programs began incorporating this updated topics list into their coursework curriculum beginning in 2021.

The required Principal Knowledge Topics are determined through a Practice Analysis Study and serve as the blueprint for the CFP® exam. Each exam question is linked to one of the Principal Knowledge Topics, in the approximate percentages indicated with the general category headings.

A.1 CFP Board's Code of Ethics and Standards of Conduct

A.2 CFP Board’s Procedural Rules

A.3 Function, purpose, and general structure of financial institutions

A.4 Financial services regulations and requirements

A.5 Consumer protection laws

A.6 Fiduciary standard and application

B.7 Financial planning process

B.8 Financial statements

B.9 Cash flow management

B.10 Financing strategies and debt management

B.11 Economic concepts

B.12 Time value of money concepts and calculations

B.13 Education needs analysis

B.14 Education savings vehicles

B.15 Education funding

B.16 Gift / income tax strategies

C.17 Principles of risk and insurance

C.18 Analysis and evaluation of risk exposures

C.19 Health insurance and health care cost management (individual and group)

C.20 Disability income insurance (individual and group)

C.21 Long-term care insurance and long-term case planning (individual and group)

C.22 Qualified and Non-Qualified Annuities

C.23 Life insurance (individual and group)

C.24 Business owner insurance solutions

C.25 Insurance needs analysis

C.26 Insurance policy and company selection

D.27 Characteristics, uses and taxation of investment vehicles

D.28 Types of investment risk

D.29 Market cycles

D.30 Quantitative investment concepts and measures of investment returns

D.31 Asset allocation and portfolio diversification

D.32 Bond and stock valuation concepts

D.33 Portfolio development and analysis

D.34 Investment strategies

D.35 Alternative investments and liquidity risk

E.36 Fundamental and current tax law

E.37 Income tax fundamentals and calculations

E.38 Characteristics and income taxation of business entities

E.39 Income taxation of trusts and estates

E.40 Tax reduction/management techniques

E.41 Tax consequences of property transactions

E.42 Tax implications of special circumstances

E.43 Charitable/philanthropic contributions and deductions

F.44 Retirement needs analysis

F.45 Social Security and Medicare planning

F.46 Eldercare and special needs planning

F.47 Types of retirement plans

F.48 Qualified plan rules and options

F.49 Non-qualified plan rules and options

F.50 Key factors affecting plan selection for businesses

F.51 Distribution rules and taxation

F.52 Retirement income and distribution strategies

F.53 Business succession planning

G.54 Property titling and beneficiary designations

G.55 Strategies to transfer property

G.56 Estate and incapacity planning documents

G.57 Gift, estate, and GST tax compliance and calculation

G.58 Sources for estate liquidity

G.59 Types, features, and taxation of trusts

G.60 Marital deduction

G.61 Intra-family and other business transfer techniques

G.62 Postmortem estate planning techniques

G.63 Planning for divorce, unmarried couples and other special circumstances

G.64 Planning for special needs and circumstances

H.65 Client and planner attitudes, values, biases

H.66 Behavioral finance

H.67 Sources of money conflict

H.68 Principles of counseling

H.69 General principles of effective communication

H.70 Crisis events with severe consequences

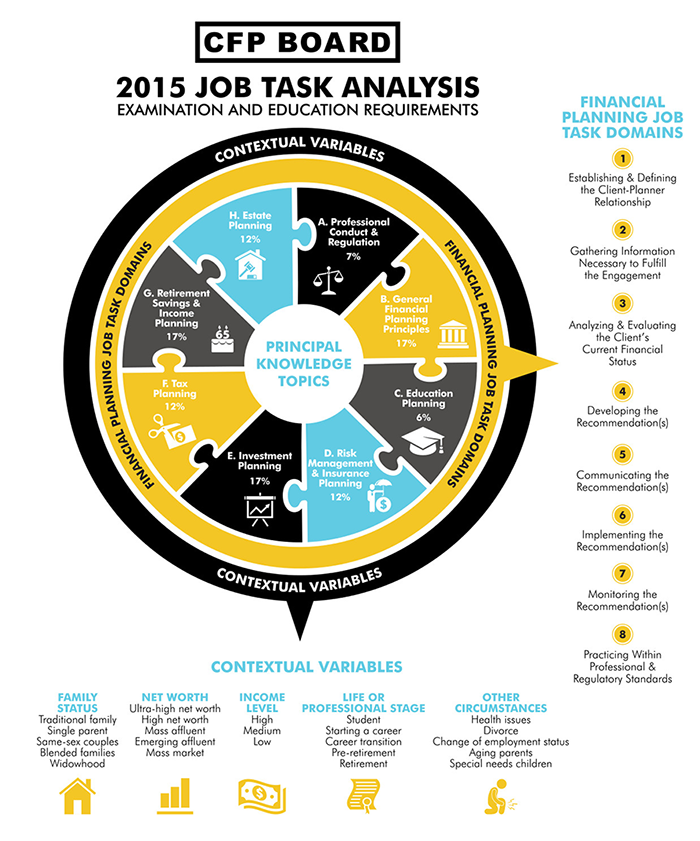

2015 Principal Knowledge Topics

The existing 2015 Principal Knowledge Topics list — along with related Contextual Variables resources — are available below for reference. Current and prospective CFP Board Registered Programs should refer to the 2021 Principal Knowledge Topics list above when developing and updating course content.

The 2015 Principal Knowledge Topics were determined through the 2015 Job Task Analysis.

A.1. CFP Board’s Code of Ethics and Professional Responsibility and Rules of Conduct

A.2. CFP Board’s Financial Planning Practice Standards

A.3. CFP Board’s Disciplinary Rules and Procedures

A.4. Function, purpose and regulation of financial institutions

A.5. Financial services regulations and requirements

A.6. Consumer protection laws

A.7. Fiduciary

B.8. Financial planning process

B.9. Financial statements

B.10. Cash flow management

B.11. Financing strategies

B.12. Economic concepts

B.13. Time value of money concepts and calculations

B.14. Client and planner attitudes, values, biases and behavioral finance

B.15. Principles of communication and counseling

B.16. Debt management

C.17. Education needs analysis

C.18. Education savings vehicles

C.19. Financial aid

C.20. Gift/income tax strategies

C.21. Education financing

D.22. Principles of risk and insurance

D.23. Analysis and evaluation of risk exposures

D.24. Health insurance and health care cost management (individual)

D.25. Disability income insurance (individual)

D.26. Long‐term care insurance (individual)

D.27. Annuities

D.28. Life insurance (individual)

D.29. Business uses of insurance

D.30. Insurance needs analysis

D.31. Insurance policy and company selection

D.32. Property and casualty insurance

E.33. Characteristics, uses and taxation of investment vehicles

E.34. Types of investment risk

E.35. Quantitative investment concepts

E.36. Measures of investment returns

E.37. Asset allocation and portfolio diversification

E.38. Bond and stock valuation concepts

E.39. Portfolio development and analysis

E.40. Investment strategies

E.41. Alternative investments

F.42. Fundamental tax law

F.43. Income tax fundamentals and calculations

F.44. Characteristics and income taxation of business entities

F.45. Income taxation of trusts and estates

F.46. Alternative minimum tax (AMT)

F.47. Tax reduction/management techniques

F.48. Tax consequences of property transactions

F.49. Passive activity and at-risk rules

F.50. Tax implications of special circumstances

F.51. Charitable/philanthropic contributions and deductions

G.52. Retirement needs analysis

G.53. Social Security and Medicare

G.54. Medicaid

G.55. Types of retirement plans

G.56. Qualified plan rules and options

G.57. Other tax-advantaged retirement plans

G.58. Regulatory considerations

G.59. Key factors affecting plan selection for businesses

G.60. Distribution rules and taxation

G.61. Retirement income and distribution strategies

G.62. Business succession planning

H.63. Characteristics and consequences of property titling

H.64. Strategies to transfer property

H.65. Estate planning documents

H.66. Gift and estate tax compliance and tax calculation

H.67. Sources for estate liquidity

H.68. Types, features and taxation of trusts

H.69. Marital deduction

H.70. Intra-family and other business transfer techniques

H.71. Postmortem estate planning techniques

H.72. Estate planning for non-traditional relationships

Donate

Donate